Climate-related disclosures for certain UK asset managers and asset owners are due imminently. The FCA's PS21/24 requirements came into force on 1 January 2022 and the first public disclosures need to be made by the largest asset management firms by 30 June 2023.

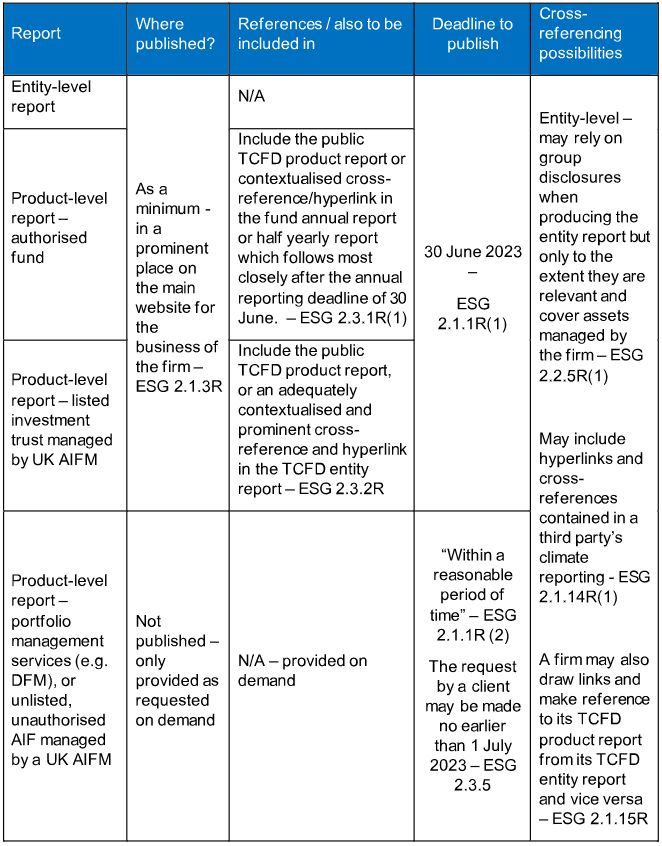

This article recaps the key aspects of the rules for asset managers as they approach the upcoming deadlines (summarised in Table 1) and covers practical implementation considerations.

The FCA's requirements at a glance

The FCA's climate-related disclosure requirements for asset managers are consistent with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

UK firms managing funds and portfolios must produce an entity-level report by:

30 June 2023 if they have more than £50bn in assets under management (AUM), or

30 June 2024 if they have less than £50bn in AUM, other than firms with less than £5bn in AUM that are currently exempt.

Where captured by the above scope, firms must publish public product-level reports for authorised and listed funds, and include or cross-reference these in ongoing client reporting.

Firms must produce on-demand product-level reports when providing portfolio management services or managing unauthorised AIFs.

Cross-referencing between entity reports and product reports is permitted, and expected (as well as with third-party reports), but firms still need to publish both where required. Material deviations must be explained.

The scope relates to assets managed by UK firms, regardless of their clients' domicile. Overseas funds being marketed in the UK are not currently captured.

TCFD-aligned disclosures

UK commercial companies with a premium or standard listing are already required by the FCA to produce TCFD-aligned disclosures on a comply or explain basis.

The purpose of PS21/24 was to introduce mandatory TCFD-aligned disclosures for UK asset owners, and UK asset management firms and their products (as set out in more detail below). The FCA's goal is to increase transparency around how firms consider climate-related risks and opportunities, enabling their clients to make more informed decisions about their investments.

Asset managers in scope

UK asset managers with more than £5bn of AUM are captured. This includes UCITS management companies (ManCos), self-managed UCITS (i.e. where an incorporated fund is also the management company), AIFMs (full-scope and small authorised) and firms providing portfolio management services. Portfolio management services comprise managing investments and (per the ESG Handbook definition) managing or advising on private assets on a recurring basis.

Importantly, the requirements capture only UK authorised firms and do not apply to overseas asset managers that market their products in the UK (for example via the UK's National Private Placement Regime). When it comes to the distribution of overseas funds to UK retail customers and any potential future requirements, it remains to be seen how the FCA proposes to operationalise the planned Overseas Funds Regime when it consults later this year.

Unlike the FCA's Sustainability Disclosure Requirements (SDR) proposals, UK distributors of overseas funds do not need to display a warning that the funds are not subject to the TCFD disclosure requirements.

Entity-level disclosures

In-scope asset managers need to produce a report that follows the TCFD structure and outlines how they consider climate-related risks and opportunities when managing investments. These entity-level disclosures must be published in a prominent place on the firm's website.

The disclosure requirements apply at a legal entity level. This means that the calculation of AUM and production of reports must be done on a legal entity (and not a group) basis. However, some cross referencing is permitted.

In-scope firms may cross-refer to relevant climate-related financial disclosures produced by a third party (for example a firm in the same group, or a delegate investment manager). The in-scope firm is still responsible for the disclosures and should set out the rationale for cross-referencing, identify any material deviations from the approach set out in the cross-referenced report, and clearly signpost to the disclosures.

Product-level disclosures

As well as preparing entity-level reports, in-scope asset managers need to prepare product-level reports. In-scope products include authorised funds (UK-domiciled UCITS and authorised AIFs)1, unauthorised AIFs managed by a UK AIFM2, and portfolio management services3.

Product-level reports will provide a set of consistent, comparable disclosures, with a core set of metrics including on greenhouse gas emissions and the weighted average carbon intensity of each portfolio.

These reports need to be either:

- Published on the firm's website and included or cross-referenced in relevant client reporting (for example, in an authorised fund's annual report). Public TCFD product reporting requirements relate to authorised funds, and listed funds with a UK AIFM (investment trusts); or

- Made available to clients on demand in the case of unlisted, unauthorised AIFs with a UK AIFM, and where firms provide portfolio management services.

What are the deadlines?

The first phase of disclosures applies to the largest asset management firms with over £50 billion in AUM. These firms need to produce entity and product-level disclosures by June 2023 — coinciding with the deadline for entity-level disclosures under the EU Sustainable Finance Disclosure Regulation (SFDR).

The second phase brings firms with more than £5 billion AUM into scope. However, the FCA mentions that firms may choose to disclose earlier to meet their own reporting timelines or client information needs.

Disclosures in the first year of reporting need to be made for the calendar year preceding the deadline — for example, where firms must report by 30 June 2023, the disclosures need to cover the 12 months from 1 January 2022. In subsequent reporting years, firms are permitted to change the reporting period provided that there is no resulting gap in coverage.

Practical implementation considerations

Firms in the first phase of disclosure requirements will have found that the process is not straightforward. Examples of challenges faced include:

- Data limitations: In order to report on portfolio Greenhouse Gas emissions, data must be gathered on portfolio companies — either directly or via third party data providers. In order to address some expressed concerns related to data gaps, the FCA's guidance states that firms are not required to disclose certain information if the lack of data or the methodological challenges cannot be addressed through use of proxies and assumptions, or if to do so would lead to misleading disclosures. Firms are still required to explain the reason behind this, and the steps being taken to help improve their data availability and disclosures.

- Divergence with other disclosure requirements: PS 21/24 only requires disclosure of metrics using the TCFD methodology. However, if a firm or group wishes to disclose against SFDR as well, it will have to take two different calculation approaches — e.g. SFDR's requirement for at least four quarterly snapshots versus FCA's one calculation date with most recent information.

- Transparency is key: the methods for producing the carbon footprint metrics will vary significantly depending on the emissions data sources used, for example whether company-specific data is available or whether industry or sector level averages are used to estimate a company's emissions. Creating a clear but detailed description of the end-to-end data collection, calculations and reporting processes, the key judgements, estimates and any over-rides, will help internal and external users of the information to understand how the metrics are calculated and how reliable and robust the estimates are. This will also help with any future questions or audits. If the calculations have been outsourced, make sure your third party provides you with this information.

Summary of the requirements (assuming a firm has greater than £50bn AUM)

Implications and next steps

In-scope firms that need to meet the 30 June deadline should now be making final preparations to publish their reports. Separately, the FCA is preparing to publish its policy statement on the UK SDR, which will extend aspects of TCFD reporting beyond climate into broader aspects of sustainability and will introduce the concept of sustainable investment labels. The FCA has announced that the policy statement has been delayed until Q3 2023 while it considers the “significant” volume of industry feedback. Despite this, asset managers will need to consider soon how best to start preparations if they are not already underway.

Contact us

Related content

1 At sub-fund level. Excludes feeder funds and sub-funds in the process of winding up or termination

2 Excluding closed-ended AIFs that make no additional investments after 22 July 2013

3 As per the FCA's ESG handbook definition - i.e. managing investments, or for private equity or other private market activities - either advising on investments or managing investments on a recurring or ongoing basis in connection with an arrangement the predominant purpose of which is investment in unlisted securities .